Updating our momentum model for the week ending 29th

Nov 2015.

Monday, 30 November 2015

Sunday, 22 November 2015

Auto index : setting up for outperformance ?

So far this year the Auto index

has been flat and outperformed many other indices in terms of price performance.

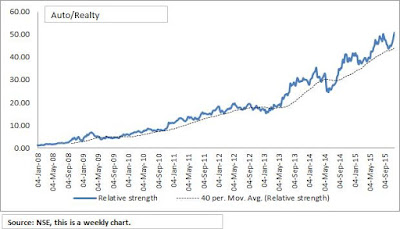

Looking at the ratio charts, it looks like the Auto space could be setting up

for its next leg of outperformance.

The Auto/Nifty ratio chart is in

all time high territory and above its 40 week moving average. Even against various indices the Auto/sector

ratio charts are above their 40 week MA’s indicating outperformance against

many indices.

So, the ratio charts are giving

an indication that maybe the Auto space would be an outperformer in the year

2016, although from an absolute returns perspective,

would like to see the Auto index itself sustaining above its 40 week moving

average.

Monday, 9 November 2015

Technicals for week ending – 8th November 2015

Nifty weekly

As I write this, the SGX Nifty is

tanking and the Nifty is about to open deep in the red. I have no clue what the

markets will do this week or next but from a longer term the trend still seems

to be down. Now I hate writing “as mentioned before” but yeah can’t help it for

now. We still have a dominant down-trend line on the Nifty and its major weightage

sector – Bank Nifty. To add more pain to the down-trend line, we have a

downward sloping 40 week MA.

Speaking of the broader market –

the Nifty 100,200 & 500 have similar structures to the Nifty and

Bank-Nifty. Hence, this tells me that the broader market too is showing a

down-trend at the moment and price improvement above the trend-line and a flattening

to upward sloping 40 week MA are the triggers that I am looking at for the

broader trend.

The Nifty/Bond ratio was in Bonds

since the start of the year !

Sunday, 8 November 2015

Monthly models update

Updated figures for the

equity-bond rotation models as of Oct’15 ending.

I first wrote about these here:

Buy & Rotate model has been

in Bonds since 30 April 2015

10 SMA model has been in Bonds

since 31 August 2015

Data & charts for Buy & Rotate model:

Data & charts for 10 SMA model:

Monday, 2 November 2015

Subscribe to:

Comments (Atom)