Monday, 25 April 2016

Technicals for week ending – 24th April 2016.

Nifty Weekly

Still continue with the

consolidation theme, but slightly leaning to the bearish side TILL we do not close above 8k on the

Nifty index.

Risks/Observations:

On the weekly

chart the difference between the Open & Close was flat compared to the high

& low which is showing some indecision.

On the daily

chart it is clearly visible that the 8k zone on Nifty has been visited several

times in the past and has acted as Support & Resistance. A break above 8k

would be a positive but till then better to wait it out.

The dollar index

and USD-INR pair bounced off support zones in the last week – trends in the

currency space could play a big role in the Equity outlook.

On the VIX

projected range chart we have closed above the upper boundary and max high

looks to be in the area near 8k. (We also have a massive build-up in the 8k

strike call option since the start of this series!)

Seeing some

improvement in the Nifty/Bond ratio chart as it is sustaining above its 10 week

moving average but momentum yet to confirm.

The most bullish

data point looks to be the Sectoral & Broader indices that are trading

above their respective 40 week moving averages.

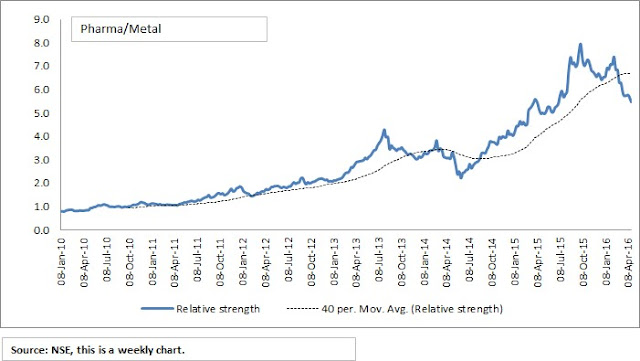

Auto, Energy,

Metal & Realty indices are the potential outperformers as they are

performing better than the Nifty & the 10 Year Bond Index (Refer Weekly

Relative Strength Charts).

To conclude – the weight of the evidence suggests a stance to the

neutral to bearish side, while the most important point to look for will be if

we can breakout above 8k.

Nifty weekly chart :

Nifty Daily chart :

US Dollar Index & USD-INR

pair :

Nifty VIX projected range chart :

Nifty/10 year bond ratio chart :

Indices above 40 week moving

average :

Sunday, 24 April 2016

Sector Momentum Model Update

Updating our momentum model for the

week ending 24th April 2016.

Short term momentum model continues to be in Metals & Realty

Thursday, 14 April 2016

Technicals for week ending – 17th April 2016.

Nifty Weekly

The bullish bias mentioned last

time worked out well. But for now looks

like we may be in for a consolidation near here.

Risks:

The index is placed

at a down sloping trend-line and a down sloping 40 week moving average.

Nifty closed

above the March highs but Bank-Nifty did not. This is the big boy and we need to

see some participation here!

Mid & Small

cap’s also closed above march highs but cooled off in the last 1 hour of

trading.

On the weekly

chart – Bank Nifty is yet to close above the 40 week moving average – in the following weeks will need to see a

lot of momentum on Nifty & Bank-Nifty to power through trend line

resistances.

On the VIX

projected range chart we have closed above the upper boundary and max high

looks to be in the area near 8k. (We also have a massive build-up in the 8k

strike call option since the start of this series!)

Seeing some

improvement in the Nifty/Bond ratio chart as it is sustaining above its 10 week

moving average but momentum yet to confirm.

Auto, FMCG,

Energy, Metal & Realty indices are above their respective 40 week moving

averages.

Nifty weekly chart :

Bank Nifty weekly chart :

Nifty & Bank-Nifty Daily

chart :

Nifty VIX projected range chart :

Nifty/10 year bond ratio chart :

Indices above 40 week moving

average :

Sector Momentum Model Update

Updating our momentum model for the

week ending 17th April 2016.

Sunday, 3 April 2016

Technicals for week ending – 03rd April 2016.

Nifty Weekly

After moving past the prior

resistance zone near 7600, the Nifty index seems to be stuck in a narrow range.

As you can see in the Nifty weekly chart below, few things stand out:

1. The

index is placed below a down sloping trend-line and a down sloping 40 week

moving average.

2. Immediate

support zone seems to be in the 7600 area which are the lows of Sep’15 and Dec’15.

Whether we break past these zones

or not? – well, we will have to see that post the RBI monetary policy meet. BUT there is some evidence which is

pointing to a bullish bias over the next 1-2 weeks and possibly further.

1. On

the weekly chart – Bank Nifty resistance zone is much higher up which gives it

further room on the upside.

2. On

the daily chart the Nifty is stuck between 7800 & 7600. RSI is sustaining

well over 50 for quite some time now. Hence a positive bias.

3. On

the VIX projected range chart we have closed above the upper boundary and max

high looks to be in the area near 8k. (We also have a massive build-up in the

8k strike call option at the start of this series! )

4. Seeing

some improvement in the Nifty/Bond ratio chart as it is sustaining above its 10

week moving average.

5. Auto,

FMCG, Energy & Metal indices are above their respective 40 week moving

average.

Nifty weekly chart :

Bank Nifty weekly chart :

Nifty Daily chart :

Nifty VIX projected range chart :

Nifty/10 year bond ratio chart :

Indices above 40 week moving

average :

Sector Momentum Model Update

Updating our momentum model for the

week ending 03rd April 2016.

Friday, 1 April 2016

Monthly models update

Updated

figures for the equity-bond rotation models as of Mar’16 ending.

I

first wrote about these here:

Buy

& Rotate model has been in Bonds since 30 April 2015

10

SMA model has been in Bonds since 31 August 2015

Data & charts for 10 SMA model:

Subscribe to:

Comments (Atom)