Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assessment of the positives and negatives

from a longer term point of view.

Nifty Weekly

Chart 1 Nifty support zone for longer

time frame comes in at 8900-9000 – which is also a gap zone.

Chart 2 Nifty & all indices

except Pharma are above their 40-week MA.

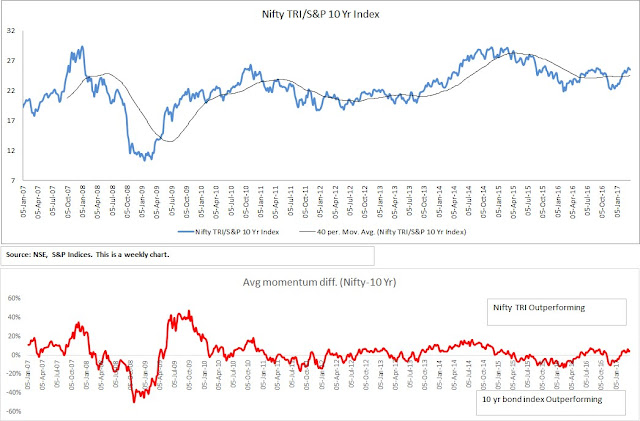

Chart

3 Nifty-Bond ratio is above its 40-week MA.

Chart

4 Longer term intermarket strength continues in Energy BUT Metals lost rank 2

to Realty index. Keeping an eye on Infra.

Chart

5 Avg. & Median distance of all sectors from their 52 week closing highs is

at -2.8% & -0.1%

Chart

6 On net basis FII are long in index futures but number of net long contracts

decreasing since beginning of April series – Possible pause for near term.