Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assessment of the positives and negatives

from a longer term point of view.

Nifty Weekly

Before we get into the data let

me just sum up how I feel right now :

Chart 1 Nifty is still in all-time

high territory so no point trying to predict a resistance zone. The weekly bar

seems a bit concerning but would rather see if we fall to lower support at 9700

and how we react there. Also, we are seeing a bit of an uptick in the number of

stocks that are now more than 20% from their 52 week highs – If Nifty

consolidates or rises and we see an uptick in that figure that would warrant

more caution or lightening up on long exposure. My stops for the longer term

trend as always is the 40 week MA.

Chart 2 Nifty & all indices

except Pharma & IT are above their 40-week MA.

Chart

3 Nifty total returns-Bond ratio is above its 40-week MA indicating longer term

outperformance for Nifty vs bonds.

Chart

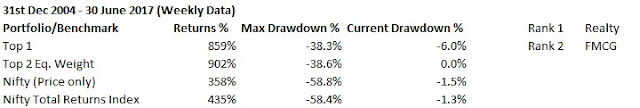

4 Longer term intermarket strength is in Realty & Bank-Nifty.

Chart

5 Avg. & Median distance of all sectors from their 52 week closing highs

improved this week and is at -3.7% & 0%.