Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assessment of the positives and negatives

from a longer term point of view.

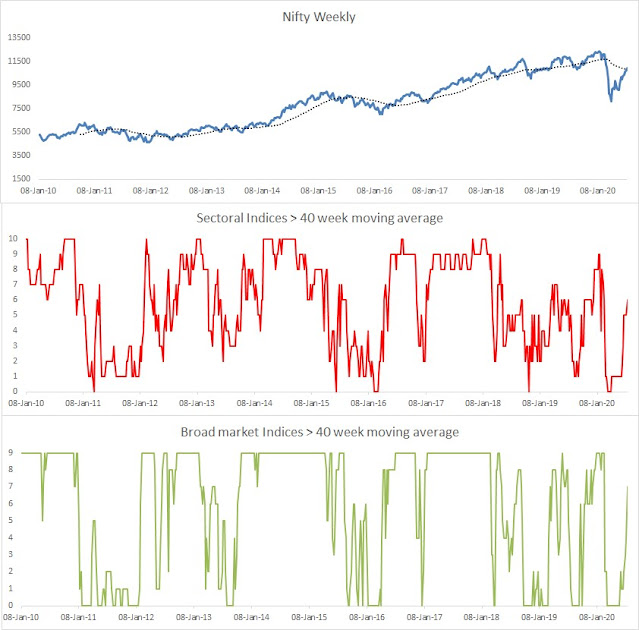

Nifty Weekly

Man, the Nifty has just overtaken the strategy completely and in such a short time-frame!

Chart 1. Strategy based on Nifty TRI – is in exit mode and I am in liquid-bees. Bond strategy is still in buy mode and I am holding a 10Y bond fund. If Green line in charts below is up means buy mode and green line at 0 means exit mode. Portfolio return since 4th November (go live) is -12.42% and current drawdown is 14.71% compared to Nifty ETF return of -8.34% with a current drawdown of 11.72%.

Chart 2 Nifty total returns/10 year Bond index ratio is BELOW its 40-week MA. Indicating longer term outperformance of Bonds vs Nifty.

Chart 3 Longer term intermarket strength is in FMCG, IT & Pharma. With Realty and Banks at the bottom.

Chart 4 7 of the broader indices are above their respective 40-week MA, and 6 of the sector indices are above its respective 40-week MA.

Chart

5 Avg. & Median distance of all sectors from their 52-week closing high is -17%

and -12%.