Sector Technicals for the week ending

– 23rd November 2014.

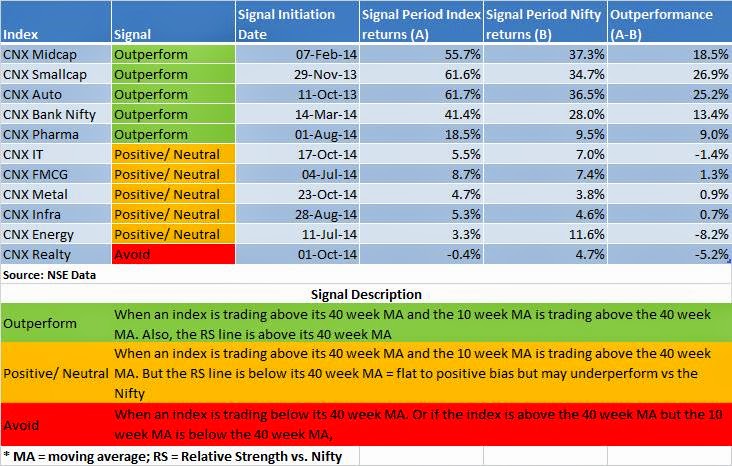

The below table is just a scan

that I run to check the overall trend of an index and its performance vs. the

benchmark Nifty. For further information please read the signal description and

the detailed sector technical analysis further below. For more information on

relative strength please click on the Relative Strength section above.

Nifty Weekly Technical Analysis:

We are back in uncharted

territory with a strong weekly close in both the Nifty and Bank-Nifty. The Nifty

index closed well above the 8400 zone which it was unable to do so convincingly

over the previous 2 weeks. Momentum wise, the RSI indicator is back in the

overbought zone and we could see an explosive rally higher (Yeah – the market

can remain overbought for extended periods of time !!) and even the MACD is

back in the buy mode. Also, many retail accounts are still short in index

futures while the FII category continues to increase their net long positions

(wondering when the brokers are going to step in and close out the shorts due

to margin calls ??). The VIX is still subdued below 14% levels – showing no

signs of nervousness as per the options market.

Sector Technicals:

CNX Auto: The Auto index

looks likely to trade within its price channel. But on a relative basis, the RS

line of the auto index failed to make a new high and is signalling muted

strength in the auto space relative to the Nifty. Also, the MACD has flat-lined

which is supportive of the above view.

Bank Nifty: The index closed at lifetime highs and on a relative

basis the RS line has inched up sharply and we could be setting up for a big rally

in banking stocks. Momentum wise the index is in overbought and can stay overbought

just like the Auto index did during the start of this year.

CNX Pharma: The index tested its resistance at the re-test zone of

its uptrend line. Remaining above the 11000 zone is key to the sustained

uptrend in Pharma stocks. 11000 and 10000 are the important supports.

CNX FMCG: The FMCG index has finally broken-out to the upside, but the

index is not likely to outperform the benchmark Nifty as the RS line is still

in a downtrend with a downward sloping 40 week moving average.

CNX IT: The IT index is still an underperformer vs. the Nifty as

its RS line is below its 40 week MA. Price action wise looks like the index is running

into some resistance in the 11,600/ 700 zones.

CNX Infra, Metal, Energy & Realty: Infra and Energy still look positive

on a short term basis as they are trading above supports. Metals have run into

an important short term resistance zone while Realty has run into resistance

around the 220 zone.

CNX Small Cap and Mid cap: The Mid cap index closes the at all-time

highs and looks setup for more upside. Small caps are still positive as they

are trading above an important support zone of 4500-4600 and a weekly closing below

4600 could lead to a sharp fall with next support zone around 4000.