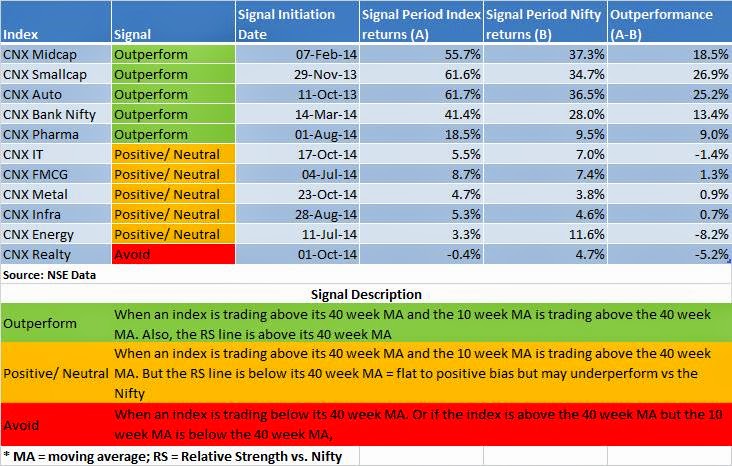

The below table is just a scan

that I run to check the overall trend of an index and its performance vs. the

benchmark Nifty. For further information please read the signal description and

the detailed sector technical analysis further below. For more information on

relative strength please click on the Relative Strength section above.

Nifty Weekly Technical Analysis:

What a week!! I mentioned last

week that the break out in Bank-Nifty could lead the Nifty index to all-time

highs but did not foresee it happening within a week. Now, the index has broken

past its previous highs of 8180 and going forward this should act as the new

support zone. We are back in uncharted territory with a strong weekly close in

both the Nifty and Bank-Nifty. However, this is a truncated week as we have 2

trading holidays so the coming week could see little price action. On the

derivatives side, the VIX is around 13% implying that the options market does

not see a volatile November series for now. FII’s increased long positions in

the index futures space by about 3,86,000 contracts and we also saw an increase

in net longs in the call option space (don’t know why the retailers are trying

to pick a top and shorting the index on such a massive breakout !! ). On a

longer time frame the 40 week moving average is at 7277 and we have an upward

sloping 40 week MA which augurs well.

Sector Technicals:

CNX Auto: The Auto index

looks likely to trade within its price channel. But on a relative basis, the RS

line of the auto index failed to make a new high and is signalling muted

strength in the auto space relative to the Nifty.

Bank Nifty: The index closed at lifetime highs and on a relative

basis the RS line has inched up sharply and we could be setting up for a big rally

in banking stocks. Momentum wise the index is not in overbought, but could

enter the overbought range above 70 and could stay overbought just like the

Auto index did during the start of this year.

CNX Pharma: The index had broken its uptrend-line shown below and

could face resistance at this re-test zone. But if it manages to breakout above

the 11000 zone then one could look to increase longs in Pharma stocks.

CNX FMCG: The FMCG index is not giving any clear signals and it

would be better to wait and watch. The FMCG index is not likely to outperform

the benchmark Nifty as the RS line is still in a downtrend with a downward

sloping 40 week moving average.

CNX IT: The IT index is no longer an outperformer as its RS line is

below its 40 week MA. Price action wise – I mentioned last week that the index

is back near its supports and can give a tradable bounce from these levels. One

can still hold longs in IT space as the index is above crucial supports.

CNX Infra, Metal, Energy & Realty: Infra and Energy still look positive

on a short term basis as they are trading above supports. Metals have run into

an important short term resistance zone while Realty could trade in a range of

180-220.

CNX Small Cap and Mid cap: The Mid cap index close the week just a tad

below its all-time highs but the setup is looking positive for a breakout to

the upside. Small caps are still positive as they are trading above an

important support zone of 4500-4600 and a weekly closing below 4600 could lead

to a sharp fall with next support zone around 4000.

No comments:

Post a Comment