Updating our momentum model for the

week ending 27th Dec 2015.

Sunday, 27 December 2015

Monday, 21 December 2015

Technicals for week ending – 20th December 2015.

Nifty weekly

The primary longer term trend

still remains down for me as the index is below its 40 week moving average and

this moving average is sloping down. This similar setup is there on the

Bank-Nifty and broader indices – Nifty 100,200 & 500. On a

short term basis – looks like the index can bounce from here as we are close to

supports of the Aug-Sep lows (shaded area).

On a relative basis, the Nifty/Bond ratio is

still below its 40 and 10 week moving averages – indicating that bonds might be

a better performer.

Saturday, 19 December 2015

Monday, 14 December 2015

Monday, 7 December 2015

Technicals for week ending – 6th December 2015.

Nifty weekly

Going through the weekly charts, for

a longer term uptrend - the Nifty and Bank-Nifty still have to overcome their

downward sloping trend-lines and a downward sloping 40 week moving average. The

Nifty 100, 200 & 500 indices still remain below their 40 week MA and are

exhibiting patterns similar to the Nifty. However, the relative strength ratio

of these indices is showing something interesting. All throughout this

downtrend the RS ratios of these broader market indices have not deteriorated

and in fact moved up – indicating that bulk of the selling has been restricted

to the Nifty 50 basket. Even the Midcap and Small cap RS ratios have been

inching higher.

On the fundamental side, as per

NSE data looks like earnings have picked up & earlier I had tweeted about a

rare occurrence in the Nifty which makes me think that we are near a short term

bottom in the index (charts below).

Overall, looks like we could be

near a bottom or maybe the Nifty index has bottomed out since the broader-market

RS ratios are healthy, we are seeing an uptick in earnings and from the

derivatives space the VIX index is calm and not indicative of any panic in the

market. On a personal note, I would still like to see the index overcome its 40

week MA for a confirmation of a longer term uptrend. Till then, good to keep

the above points in mind and monitor.

Charts : A rare occurrence &

earnings improvement

Sunday, 6 December 2015

Monthly models update

Updated figures for the

equity-bond rotation models as of Nov’15 ending.

I first wrote about these here:

Buy & Rotate model has been

in Bonds since 30 April 2015

10 SMA model has been in Bonds

since 31 August 2015

Data & charts for Buy & Rotate model :

Data & charts for 10 SMA model:

Monday, 30 November 2015

Sunday, 22 November 2015

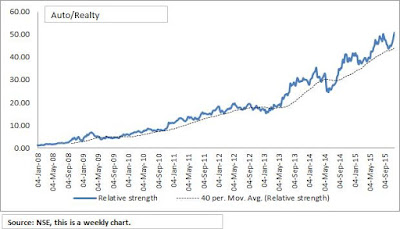

Auto index : setting up for outperformance ?

So far this year the Auto index

has been flat and outperformed many other indices in terms of price performance.

Looking at the ratio charts, it looks like the Auto space could be setting up

for its next leg of outperformance.

The Auto/Nifty ratio chart is in

all time high territory and above its 40 week moving average. Even against various indices the Auto/sector

ratio charts are above their 40 week MA’s indicating outperformance against

many indices.

So, the ratio charts are giving

an indication that maybe the Auto space would be an outperformer in the year

2016, although from an absolute returns perspective,

would like to see the Auto index itself sustaining above its 40 week moving

average.

Monday, 9 November 2015

Technicals for week ending – 8th November 2015

Nifty weekly

As I write this, the SGX Nifty is

tanking and the Nifty is about to open deep in the red. I have no clue what the

markets will do this week or next but from a longer term the trend still seems

to be down. Now I hate writing “as mentioned before” but yeah can’t help it for

now. We still have a dominant down-trend line on the Nifty and its major weightage

sector – Bank Nifty. To add more pain to the down-trend line, we have a

downward sloping 40 week MA.

Speaking of the broader market –

the Nifty 100,200 & 500 have similar structures to the Nifty and

Bank-Nifty. Hence, this tells me that the broader market too is showing a

down-trend at the moment and price improvement above the trend-line and a flattening

to upward sloping 40 week MA are the triggers that I am looking at for the

broader trend.

The Nifty/Bond ratio was in Bonds

since the start of the year !

Sunday, 8 November 2015

Monthly models update

Updated figures for the

equity-bond rotation models as of Oct’15 ending.

I first wrote about these here:

Buy & Rotate model has been

in Bonds since 30 April 2015

10 SMA model has been in Bonds

since 31 August 2015

Data & charts for Buy & Rotate model:

Data & charts for 10 SMA model:

Subscribe to:

Comments (Atom)