Nifty Weekly Technical Analysis:

The Nifty closed the week right

near its long term supports of 8180-8200 zones. However the index is below its

40 week moving average and as per my rules I am in exit mode. Price action

wise, I would say the longer term trend would turn negative if we close the

week below the support of 8180. On the technical front the MACD histogram

registered its highest negative reading in 3 years while the RSI is also below

50 after more than a year. Also, the India VIX at 19% suggests a bit of volatility ahead. The factors mentioned suggest that the coming weeks would

resolve to the downside but let the price action confirm if the week closes

below 8180. As per the rules, I am out as the index is below its 40 week moving

average. On the flows front, FII’s have

reduced net longs drastically and have increased positions in put options.

Sector Technicals:

CNX Midcap and Smallcap: Both the indices have closed below

supports and are just above their 40 week MA’s. Various factors are suggesting

a resolution to the downside. However it would be prudent to hold till the week

closes above its 40 week MA. Factors are – Both indices have a negative MACD, RSI

below 50 after a long time and the 10 week MA slope is now downward sloping.

CNX Auto: As mentioned

before, relative to the Nifty, it looks difficult to outperform as the RS line

is not making new highs and has reverted to its 40 week moving average. 8000 is

going to be an important medium/long term support for the Auto index. Its exit

mode for the Auto space as it has closed below its 40 week MA.

Bank Nifty: The banking index is precariously perched just at its

40 week MA and below a downward sloping 10 week MA. And medium term support is

just at 17700. A close below 40 week MA and below 17700 would spell trouble,

but if you are looking for a short term trade on the long side I think this is

the best candidate in terms of risk-reward. Beware of 17700!

CNX Pharma: As mentioned before, the 13000 level holds the key for

a sustained uptrend, better to reduce long exposure for some time till we get 2

weeks of continuous closing above the 13000 mark.

CNX FMCG: It was surprising to see that the FMCG index could not

hold its 40 week MA !. Its not a pretty picture for the FMCG index as we are

below the 40 week MA and support of 20000. Better to wait and watch.

CNX IT: The IT is still below its second support zone and its 40

week moving average. I would be a buyer only above the 40 week moving

average..but hey that’s just me !

CNX Infra, Metal, Energy & Realty: All 4 indices are in exit

mode as they are below their 40 week MA’s. Metals looks promising at first but

then got beat down below supports. There could be a tradable bounce in the

metals space but for longer term better to wait for a move above the 40 week MA

and a positive crossover of the 10 and 40 week MA’s.

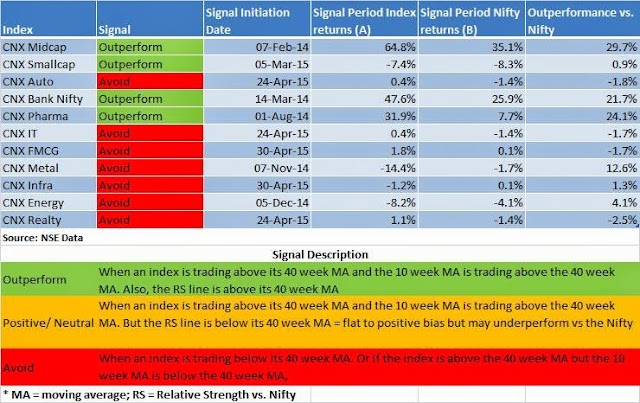

The below table is just a scan

that I run to check the overall trend of an index and its performance vs. the

benchmark Nifty. For more information on relative strength please click on the

Relative Strength section above.

No comments:

Post a Comment