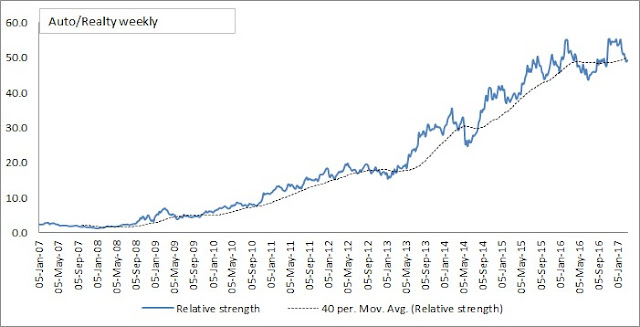

Latest data set suggests that the

Auto Index could see lacklustre performance compared to other sectoral indices.

Not doing anything different, just following the process like we did for the

previous write ups done below -

Process: We are just dividing each sector index by one another and

applying a moving average filter to check if the numerator is outperforming or

underperforming. So, in this case just like the one’s above, the Auto Index is

divided by all sector indices and if the ratio is above the 40-week moving

average then the Auto index is outperforming and when the ratio charts are above or below the moving average filter

against all Indices then that becomes very important as it is signalling a

possible shift in sector preferences. This exact scenario played out in the

Pharma Index in April 2016 and has been a lackluster performer ever since. Also,

in November 2016 the Energy Index did something similar but the ratios were above the moving average, hence signalling longer term outperformance.

This is just a probability thing

and if the ratio’s start to improve then obviously, that will signal a change

and Auto stocks will be back in favor.

Anyways, below are the ratio

charts and you can see that the Auto/sector ratios are below their respective

moving average filter for all except the Auto/Pharma ratio as Pharma has done

nothing since long so the denominator did not change much.

Do keep in mind that since these

are weekly charts & data so this is analysis is more longer term oriented.

No comments:

Post a Comment