Friday, 23 February 2018

Sunday, 18 February 2018

Technicals for week ending – 16th February 2018.

Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assesment of the positives and negatives

from a longer term point of view (6-12 months).

Nifty Weekly

After seeing a new all time high

almost every week of 2017, seeing some signs now that we are in for a rocky

year. I am not a fan of predictions BUT trailing stops for my niftybees

position is a bit away and seeing some confluence of supports and data points

that warrant caution. To strike a balance between the two the only thing that

comes to mind is to sell a little bit now and leave the rest with a trailing

stop.

Below I present a few points that resemble what I feel is a perfect storm, again, NOT a fan of predictions but there is this feeling that is just tucking away..

Ok, so firstly (all charts below the write-up), I see

Nifty closing in the support band for the week and just above the upward

sloping channel connecting the lows since September 2017. Also, the true range

based super-trend indicator is just below and a weekly close below this would

flip the trend to down. So roughly, a weekly close below 10,350 would break 3

zones : the super-trend indicator, upward sloping demand channel and previous

resistance zone from last quarter of 2017 which was around 10,450. Moving on,

the damage under the surface is pretty evident with almost 40% of Nifty 500

stocks down more than 20% from their respective 52 week highs. Intraday

volatility has increased with increase in number of sessions seeing a more than

1% swing between intraday high-low. After being on the wrong side the

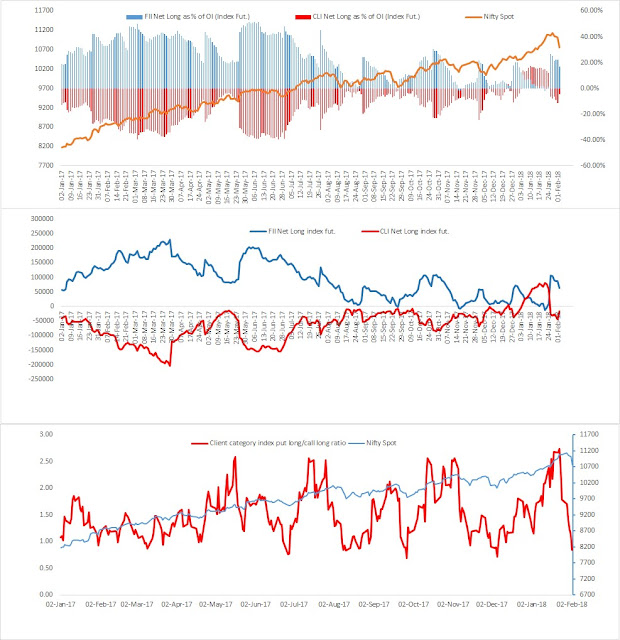

whole of 2017, client category turns net long in index futures in 2018 & at

the moment hold more long index call options than long puts.

Sunday, 4 February 2018

Technicals for week ending – 02nd February 2018.

Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an asses.ment of the positives and negatives

from a longer term point of view.

Nifty Weekly

Chart 1. For the short term, had

mentioned last week that it looks a bit stretched as we had 2 consecutive

weekly closes above the standard 20/2 Bollinger Bands. Below is the weekly

chart on different timeframes and the 3 week chart looks ominous with that

pinbar action. For now, keeping an eye out on 10500 as short-term support. We

are in all time high territory so basic logic and common sense says uptrend

intact on longer time-frame. The index is still above its rising 40 week moving

average – keeping the trailing stops for now. As for underlying stocks from the

Nifty 500, less than 20% are trading more than 20% of 52 week highs.

Chart 2 Nifty total returns/10 year Bond index ratio is above its 40-week MA &

momentum also favours Nifty index, indicating longer term outperformance for

Nifty vs bonds.

Chart 3 Longer term intermarket strength as per the RS matrix is in IT & Metals.

With Auto and Pharma at the bottom.

Chart

4 All

indices except Pharma are above their 40-week MA.

Chart

5 Avg. & Median distance of all sectors from their 52-week closing high is

at -6.5% & -5.6%.

Chart

6 FII flows in Index futures segment is positive.

Thursday, 1 February 2018

Monthly Update

Updated

figures for the equity-bond rotation models as on end January’18.

Data set: Nifty Total Returns Index & S&P

BSE India 10 Year Sovereign Bond Index

I

first wrote about these here:

The

Moving average model switched to Nifty total returns index in end January 2017

The

Momentum model switched to Nifty total returns index in end February 2017

Subscribe to:

Comments (Atom)