Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an asses.ment of the positives and negatives

from a longer term point of view.

Nifty Weekly

Chart 1. For the short term, had

mentioned last week that it looks a bit stretched as we had 2 consecutive

weekly closes above the standard 20/2 Bollinger Bands. Below is the weekly

chart on different timeframes and the 3 week chart looks ominous with that

pinbar action. For now, keeping an eye out on 10500 as short-term support. We

are in all time high territory so basic logic and common sense says uptrend

intact on longer time-frame. The index is still above its rising 40 week moving

average – keeping the trailing stops for now. As for underlying stocks from the

Nifty 500, less than 20% are trading more than 20% of 52 week highs.

Chart 2 Nifty total returns/10 year Bond index ratio is above its 40-week MA &

momentum also favours Nifty index, indicating longer term outperformance for

Nifty vs bonds.

Chart 3 Longer term intermarket strength as per the RS matrix is in IT & Metals.

With Auto and Pharma at the bottom.

Chart

4 All

indices except Pharma are above their 40-week MA.

Chart

5 Avg. & Median distance of all sectors from their 52-week closing high is

at -6.5% & -5.6%.

Chart

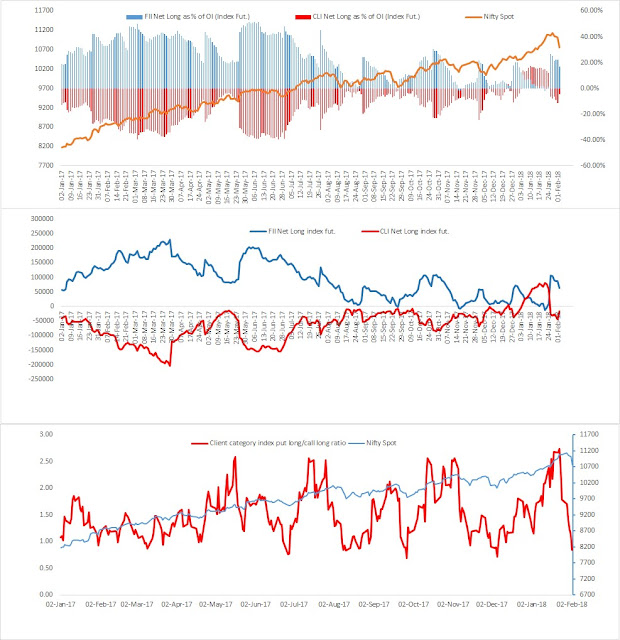

6 FII flows in Index futures segment is positive.

No comments:

Post a Comment