Note : This is not a recommendation and I am not a registered analyst, these are just data points and an assessment of the positives and negatives from a longer term point of view.

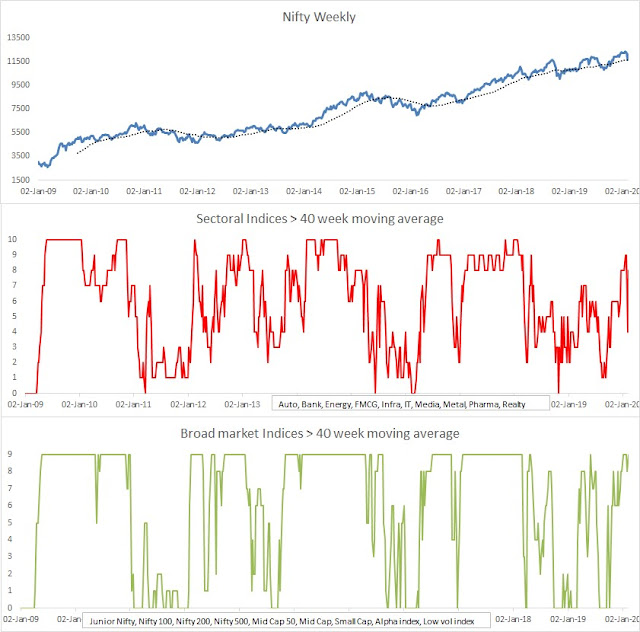

Nifty Weekly

Chart 1. Strategy 1 & 2 based on Nifty TRI data remain long and I am holding Niftybees. Bond strategy also is in buy mode and I am holding a 10Y bond fund. Green line is up means buy mode and green line at 0 means exit mode.

Chart 2 Nifty total returns/10 year Bond index ratio is ABOVE its 40-week MA & momentum is in Nifty, both indicating longer term outperformance of Nifty vs Bonds.

Chart 3 Longer term intermarket strength as per the RS matrix is in Realty, IT & Pharma. With Media and Energy at the bottom.

Chart 4 9 out of 10 of the broader indices are above their respective 40-week MA, and 8 sector indices are above their respective 40-week MA. Forward returns on Nifty have generally been positive at these readings.

Chart 5 Avg. & Median distance of all sectors from their 52-week closing high is at -8.6% & -6.7%.

No comments:

Post a Comment