Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assessment of the positives and negatives

from a longer term point of view.

Nifty Weekly

Chart 1. Strategy based on Nifty TRI

– is in exit mode and I am in liquid-bees. Bond strategy is still in buy mode

and I am holding a 10Y bond fund. If Green line in charts below is up means buy

mode and green line at 0 means exit mode. Portfolio return since 4th

November (go live) is -12.75% and current drawdown is 15% compared to Nifty ETF

return of -12.74% with a current drawdown of 16%.

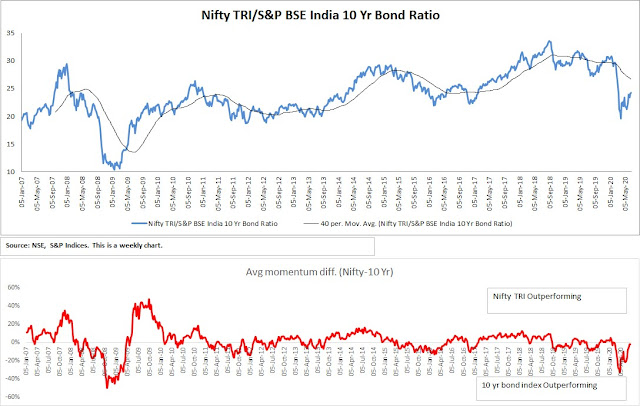

Chart 2 Nifty total returns/10 year Bond index ratio is BELOW its 40-week MA & momentum has shifted to Bonds, both indicating longer term outperformance of Bonds vs Nifty.

Chart 3 Longer term intermarket strength is in Energy, Infra & Pharma. With Realty

and Banks at the bottom.

Chart

4 2 of the broader indices are above their respective 40-week MA, and 5

of the sector indices are above its respective 40-week MA.

Chart

5 Avg. & Median distance of all sectors from their 52-week closing high is -19%

and -15%.

No comments:

Post a Comment