Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assessment of the positives and negatives

from a longer term point of view.

Nifty Weekly

Chart 1. Since beginning of November

(all 3 strats live), the strategy portfolio has lost 3.31% with a max drawdown

of -5.84% whereas the Nifty ETF lost 7.25% and has a max drawdown of -10.68%.

Even if all stop losses were to hit tomorrow, the theoretical loss on the

portfolio is a further ~8% from here.

Strategy 1 & 2 based on Nifty TRI

data remain long and I am holding Niftybees. Bond strategy also is in buy mode

and I am holding a 10Y bond fund. Green line is up means buy mode and green

line at 0 means exit mode.

Chart 2 Nifty total returns/10 year Bond index ratio is BELOW its 40-week MA &

momentum has shifted to Bonds, both indicating longer term outperformance of Bonds

vs Nifty.

Chart 3 Longer term intermarket strength as per the RS matrix is in Realty, IT

& Pharma. With Metals and Media at the bottom.

Chart

4 2 out of 10 of the broader indices are above their respective 40-week MA, and just

1 sector index is above its respective 40-week MA. Forward returns on Nifty

have generally been negative to flattish at these readings.

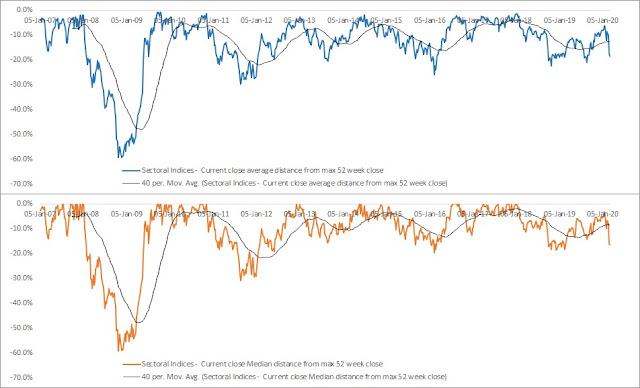

Chart

5 Avg. & Median distance of all sectors from their 52-week closing high is

at -18.9% & -16.6%.