Note : This is not a recommendation and I am not a registered analyst,

these are just data points and an assessment of the positives and negatives

from a longer term point of view.

Nifty Weekly

We had a rare development this week

as the Nifty closed above its upper Bollinger band. This has happened 20 times

since 2010. BUT 2014 looks like a big outlier due to the election rally &

2014 saw 10 instances of Nifty giving a weekly close above this band – which does

sound like a outlier. Anyways, here are the results 1/3/6 months out from the

signal date.

Chart 1 OK, back to good old

support-resistance and a dumb moving average. The Nifty is sustaining above

prior resistance and we have an upward sloping 40 week MA and the ATR based

super-trend has also shifted higher. Both these are near important support zone

of 9700. Under the surface, the damage seems to be spreading with almost 30% of

the Nifty 500 stocks that are now more than 20% below their 52 week highs. I don’t

have much data but the current period seems eerily similar to the early 2015

time period. What now? – Well, 2017 has been a record of sorts with every

market going up! Even the Nikkei is pushing through levels not seen in almost

20 years. Despite the lacklustre data point above & the damage underneath I

still maintain the positive bias – let the support break and price show some signs,

then will think on risk-off terms.

Chart 2 Nifty total returns/10 year Bond index ratio is above its 40-week MA &

momentum also favours Nifty index, indicating longer term outperformance for

Nifty vs bonds.

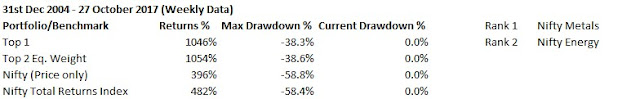

Chart 3 Longer term intermarket strength as per the RS matrix is in Metals & Energy.

They are a bit slow to signal so keep in mind the general conditions.

Chart

4 Pharma

index is below its 40-week MA.

Chart

5 Avg. & Median distance of all sectors from their 52-week closing high is

at -2.7% & 0%.

Chart

6 FII flows in Index futures segment are positive and rising.